Jun 15, 2016

Social Payment is Here - Views from PayExpo 2016

Andrew Wilmot, P92 Group Nearshore IT Director, talks about views from PayExpo 2016 about how payment will be embedded in social networks.

Research from BI Intelligence indicates that the social media share of eCommerce referrals grew by 200 percent from 2014 to 2015. Circle, the social payment platform launched in the UK last week with the support of Barclays. This is a true pure-play social payment platform and not an adjunct to another payment proposition. So are social payment platforms here to stay?

According to Forrester, mobile is the preferred channel for ecommerce and will be $91billion USA by 2019. So where does social payment fit in? Social payment is an apex on the magic triangle of mobile payments and wallets, and the features of each apex appear to be merging – so how does social payment differ?

I chaired a panel on ‘To what extend will payments embed in social media’ at PayExpo 2016 on 7th June 2016. PayExpo is the premier event for the payments industry across Europe. I approached the topic with the background of being an early adopter of social gifting and deployer of employee, loyalty, & channel reward programmes.

We had some great speakers in the panel:

- Keir Breitenfeld, Strategic Partnerships and Chanel Manager, at Trulioo. Their brand name says what they do - insuring that in payments it is ‘Truly You’. Keir came from an identity risk management, & fraud operations management background. Keir was a former U.S. Navy surface warfare officer which appeared to be a good preparation but sadly time did not allow us to ask him about this.

- Silvia Mensdorff-Pouilly, General Manager European Payment Intermediaries, ACI Worldwide. Silvia has spent 15 years’ experience in consumer payments and a key theme was about making consumer payments seamless and customers focused. Syvlia is an active participant of FemTechLeaders and Woman in Payments.

- JB McCarthy, Development Director, Financial Services Innovation Centre at the University of Cork Business School (CUBS) and a member of the Consumer Advisory Group of the Central Bank of Ireland.

The concept of social payments is big in Asia and the panel spoke about what we can learn from ‘BAT’ (Baidu, Alipay and Tencent) what is driving change so quickly. The use of mobile phones for purchase transactions is a key differentiator between growth in Asia and Europe. Conversely new developments from ‘GAFA’ (Google, Apple, Facebook and Amazon) in the European marketplace lack the sense of anything really new. Innovation has been driven by bricks and mortar banks like Barclays PingIt. Facebook’s 200 million user creates a fertile ground when compared to MasterCard’s 79 million users.

The view from the panel was that the level of trust in social networks for payment is much lower compared to other payment methods like PayPal, but consumers will accept the risk for micro payments on social platforms today. Social payment platforms can innovate by providing the following. A true social payment app needs to offer one or more of these:

- Social sign-on – say using Facebook to login

- Importing Facebook friends or phone contacts into the payment app

- Matching up contacts and on their social media profile – such as finding profile photos on Facebook without permission

- Notifying recipients of a gift or payment by Facebook/Twitter/WhatsApp message or post

- Purchase suggestions are socially shared

- Social shares or promoted posts have ‘buy’ buttons

- QR codes and phone cameras

Social media messaging is on the whole not carrying the payment itself. However, the panel view is that social payment will be peer-to-peer in its nature. Each participant would need to be on the platform and the platform would provide the identity and transactional security. There are risks in the aggregation of personal data for transactions between social network and the payment system – so social and payment elements need to be kept segregated.

The view was that social networks can help in identifying a person or merchant and there are great opportunities there but it will not progress in the short term as results are not predictable and it’s not clear who would be liable. Also, payment processes can be embedded in social posts so that they become seamless on the one side without forcing consumers/merchants to use a particular payment type and provide choice. The view was that just putting a ‘buy’ button on a twitter post is not really viable as it’s not the right context to browse, review and decide on a purchase. Payment opportunities must be offered in the right context.

The view was that mobile is “king” and for social payment to improve its position consumer trust needs to be built. Social payments need to move on from sharing restaurant bills to larger transactions. This puts bricks and mortar banks and challenger banks in the driving seat. It will be interesting to see which sector delivers the best innovation over the coming year. Social type payments in Europe have been thriving in the B2B sector and to some extend P2P payments need to catch up.

Jack Dorsey is back as CEO of Twitter from Square having pioneered Square Pay. Snapchat has bought Spring Pay. Circle is using Bitcoin for social gifting in peripheral markets – how will Blockchain technology get added in? How will Alipay progress within WeChat. How will SnapCash fare? Will ClearXchange continue to lead the B2B market with over 100 m online banking customers. How will Venmo’s offering be rolled out consistently across Europe? 2016 is going to be an exciting year!

Most popular

-

Jun 14, 2016

P92 Sponsored IMA Drinks Reception at PayExpo

-

Dec 10, 2015

P92 Attended IMA Europe December Meeting in Bruges

Latest blogs

-

Feb 1, 2024

Colleague Chronicles: Zoltán Seres, Project Lead

-

Nov 24, 2023

Colleague Chronicles: Anna Uhrinyi, Manager Assistant

-

Oct 19, 2023

Colleague Chronicles: Gábor Tóth, Team Lead

-

Sep 8, 2023

Colleague Chronicles: Levente Soóky, Full Stack Developer

-

Aug 2, 2023

Colleague Chronicles: Richárd Rőfi, DevOps intern

-

Jun 30, 2023

Colleague Chronicles: Lajos Marton, Team Lead

-

Jun 1, 2023

Toll Management System

-

Jun 8, 2021

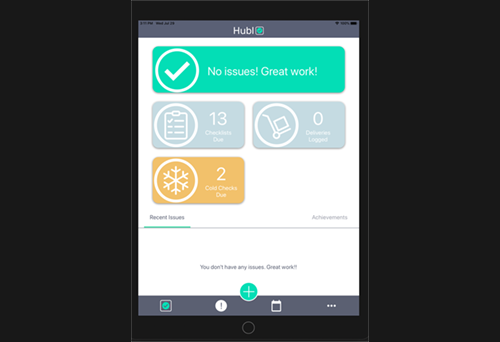

Staff Wellbeing App for an award-winning UK based Quality Home Care & Support Services Provider

-

Oct 15, 2020

Business Gifting Web App for Motivates Inc

-

Oct 15, 2020

Food Safety Workplace Tablet App